BTC Price Prediction: Navigating the Path to $200K and Beyond

#BTC

- Technical indicators show consolidation below the 20-day MA with MACD suggesting short-term bearish momentum

- Mixed news sentiment with positive institutional adoption offset by technical challenges and demand concerns

- Long-term trajectory remains bullish with projections reaching $1M+ by 2040 based on scarcity and adoption trends

BTC Price Prediction

Technical Analysis: BTC Consolidates Below Key Moving Average

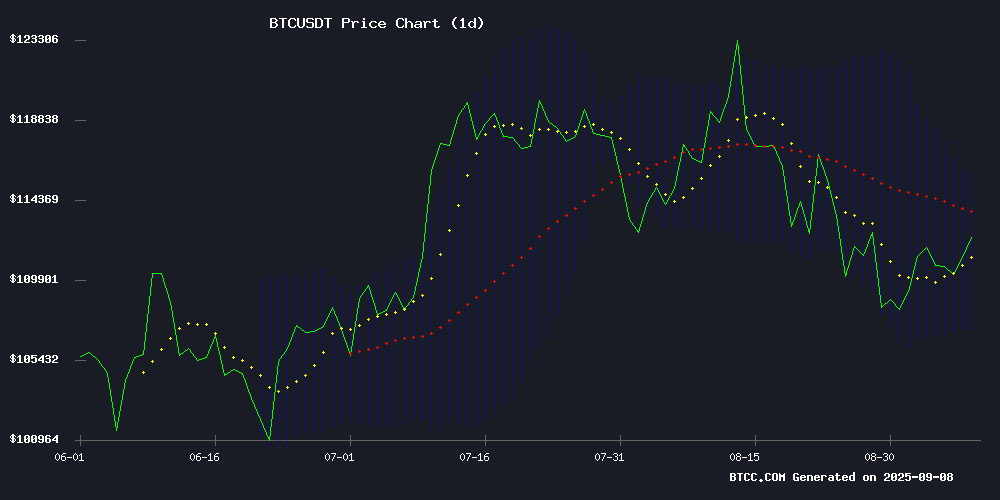

BTC is currently trading at $111,017.55, slightly below the 20-day moving average of $111,485. The MACD indicator shows a bearish crossover with the signal line at 3,157.43 and the MACD line at 2,484.58, resulting in a negative histogram of -672.85. Bollinger Bands indicate consolidation with price trading between the upper band at $115,890.67 and lower band at $107,079.33. According to BTCC financial analyst William, 'The current technical setup suggests short-term consolidation with key resistance at $115,940. A break above this level could trigger momentum toward $126,874 by month-end.'

Market Sentiment: Mixed Signals Amid Institutional Developments

Market sentiment reflects a complex landscape of institutional adoption and technical challenges. El Salvador's continued accumulation of Bitcoin holdings to $700 million demonstrates sovereign confidence, while Tether's denial of Bitcoin sell-off rumors reinforces institutional commitment. However, concerns around Bitcoin Core's potential censorship of Ordinals transactions and weakening treasury demand present headwinds. BTCC financial analyst William notes, 'The $83 billion in buying pressure not moving prices significantly compared to $2 billion sales causing crashes indicates market structure evolution. Current consolidation may represent a bear trap before the next leg higher.'

Factors Influencing BTC's Price

Bitcoin Price Outlook: Critical Resistance at $114K Holds Key to Market Direction

Bitcoin's price action faces a decisive moment as it struggles to overcome the $114,000 resistance level. Analysts warn that failure to breach this threshold could trigger a deeper correction, despite recent recovery attempts.

Crypto analyst BitBull identifies $114,000 as the critical resistance point for BTC. The digital asset has repeatedly tested this level on daily timeframes, only to face rejection each time. These failed attempts suggest the former support level has now flipped to strong resistance.

The timing of any potential breakout carries significant weight. Prolonged consolidation below $114,000 increases the probability of bearish momentum taking hold. Short-term rallies that don't decisively reclaim this level may prove to be bull traps, setting the stage for further downside.

The 2025 Spam Wars Are Becoming a ‘Serious Threat’ to Bitcoin

Bitcoin's ecosystem is once again embroiled in a heated debate, echoing the divisive Blocksize Wars of the past. This time, the conflict centers on OP_RETURN and the growing rift between Bitcoin Core and Knots developers. The Spam Wars, as they’ve come to be known, threaten to destabilize the network by exacerbating transaction fees and bloating the blockchain with non-financial data.

The roots of the conflict trace back to 2023, when Ordinals introduced a way to embed digital art and NFTs directly onto Bitcoin’s blockchain. While some celebrated this innovation, others warned of impending spam and congestion. By early 2025, tensions escalated as Bitcoin Core proposed lifting the 80-byte OP_RETURN limit in its v30 release, aiming to expand Bitcoin’s utility. Critics, like Bitcoin Knots lead developer Luke Dashjr, argue this move invites abuse, risking Bitcoin’s efficiency and financial focus.

El Salvador Expands Bitcoin Holdings to $700M Despite IMF Constraints

El Salvador has added 21 BTC to its national treasury, commemorating the fourth anniversary of its groundbreaking Bitcoin Law. The purchase brings the country's total holdings to 6,313.18 BTC—valued at approximately $701 million at current prices.

The symbolic acquisition mirrors Bitcoin's 21 million supply cap, reinforcing President Nayib Bukele's unshaken commitment to cryptocurrency adoption. This comes despite an IMF loan agreement requiring the government to pause further Bitcoin accumulation.

Since 2021, El Salvador has served as a global test case for Bitcoin as legal tender, aiming to reduce remittance costs and boost financial inclusion. The strategy persists through daily 1 BTC purchases since March 2023, defying traditional financial institutions' warnings about volatility and policy conflicts.

Tether CEO Denies Bitcoin Sell-Off for Gold Investments

Tether CEO Paolo Ardoino has publicly refuted claims that the stablecoin issuer liquidated Bitcoin holdings to purchase gold. The denial came via social media platform X, where Ardoino emphasized Tether's continued commitment to Bitcoin as a core reserve asset alongside gold and real estate. "Tether didn’t sell any Bitcoin," Ardoino stated, framing the company's strategy as a hedge against macroeconomic uncertainty.

Rumors originated from a YouTuber's analysis of Tether's quarterly reserves, suggesting a $1 billion BTC sell-off and $1.6 billion gold acquisition. Jan3 CEO Samson Mow discredited these claims, noting the omission of 19,800 BTC transferred to subsidiary Twenty One Capital. The discrepancy highlights how partial data interpretation can distort market narratives.

Bitcoin Treasury Demand Shows Signs of Weakening as Purchase Sizes Shrink

Bitcoin treasury holdings have reached record levels this year, with aggregate balances hitting 840,000 BTC. Strategy leads the pack, accounting for 637,000 BTC of the total. Yet beneath the surface, a cautious trend emerges.

Average purchase sizes have collapsed by 86% from early 2025 highs. Strategy bought just 1,200 BTC per transaction in August, while other firms averaged 343 BTC. The numbers reveal a striking divergence: transaction activity remains near record levels, but deal sizes have shrunk dramatically.

Strategy acquired only 3,700 BTC in August compared to 134,000 BTC at its peak last year. Other treasury firms slipped to 14,800 BTC from highs of 66,000 BTC. This suggests treasuries remain active but are unwilling to commit large blocks of capital, potentially signaling liquidity constraints or waning conviction.

Bitcoin Targets $115,940 Short-Term, $126,874 by Month-End Despite Current Consolidation

Bitcoin continues to trade in a critical zone as September 2025 unfolds, with the cryptocurrency currently priced at $110,843.90. Technical analysis reveals a compelling setup suggesting upward momentum is building, despite recent consolidation below its 52-week high of $123,306.43.

Short-term targets project a 4.6% rise to $115,940, with medium-term expectations reaching $126,874-$130,000 by month-end. Immediate resistance sits at $117,429.05, while strong support holds at $107,255.00.

The Financial Times maintains the most aggressive long-term forecast at $200,000, citing potential regulatory clarity under the Trump administration. This contrasts with more conservative short-term predictions from CryptoNews and Coindcx, which align around the $111,627-$112,000 range.

Bitcoin Core Faces Backlash Over Potential Censorship of Ordinals and Runes Transactions

Leonidas, host of The Ordinal Show, has issued a stark warning to Bitcoin Core, asserting that any attempt to censor Ordinals and Runes transactions would violate Bitcoin's foundational principle of censorship resistance. The network's neutrality and permissionless nature are non-negotiable, he argues, drawing a direct line between censoring memecoins and the slippery slope of state-level financial censorship.

The debate has ignited a migration among node operators, with Bitcoin Knots—a client offering aggressive anti-spam features—seeing its share of the network surge from 69 nodes in early 2024 to over 4,200 by September 2025. This exodus underscores growing discontent with Bitcoin Core's proposed v30 release, which some fear could compromise the network's openness.

At stake is more than just transaction filtering. The Spam Wars have become a proxy battle for Bitcoin's soul, pitting purists against pragmatists in a clash over whether the blockchain should prioritize purity or adaptability. The outcome could reshape the ecosystem's trajectory.

Bitcoin Price Drop Could Be a Bear Trap, Says Expert Trader

Bitcoin's recent pullback from all-time highs may be setting the stage for a dramatic short squeeze, according to trader Luca. The current price action mirrors a 2024 fractal that preceded BTC's explosive November breakout.

Market makers appear to be manipulating order books to keep BTC range-bound, luring bears into complacency. This tactic was deployed successfully last year during a prolonged consolidation phase. The longer prices remain stagnant, the higher the likelihood of a violent upside move.

Key indicators suggest this isn't a bearish signal despite the absence of new higher highs since mid-August. Short positions are being carefully managed, with protected levels creating the perfect conditions for a liquidity grab. When the breakout comes, it could trigger cascading liquidations.

Bitcoin (BTC) Price Prediction: Eyes $200K Rally After Rebounding From $110K Support

Bitcoin's price resilience above $110,000 signals potential for a sustained upward trajectory. Whale accumulation and institutional inflows are driving momentum, with technical analysis suggesting a bullish consolidation pattern. The $110K level now serves as critical support, with resistance looming between $112K and $114K.

Market capitalization stands at $2.21 trillion, reflecting robust investor confidence. Analysts emphasize that holding the $110K floor is pivotal for Bitcoin's next major move. Short-term charts indicate weakening momentum, yet the broader trend remains optimistic.

Tether Denies Bitcoin Sell-Off Rumors, Reinforces Commitment to BTC and Hard Assets

Tether CEO Paolo Ardoino has categorically denied rumors of a Bitcoin sell-off, calling them baseless FUD. The stablecoin issuer instead reaffirmed its strategy of allocating excess profits into hard assets—Bitcoin, gold, and land—as part of its long-term reserve management.

The speculation originated from a YouTuber's misinterpretation of Tether's quarterly attestations, which appeared to show a reduction in BTC holdings. However, Jan3 CEO Samson Mow clarified the discrepancy: Tether had transferred 19,800 BTC to Twenty One Capital, a Bitcoin-native platform, as part of a strategic allocation rather than a liquidation.

With over 100,521 BTC ($11.17 billion) still under management, Tether remains one of the largest institutional Bitcoin holders globally. The incident underscores the market's hypersensitivity to whale movements and the importance of transparent communication from major players.

Why $83B in Bitcoin Buying Pressure Doesn't Moon the Price Like $2B Sales Crash It

Bitcoin's price dynamics reveal an asymmetry between large sell orders and sustained institutional buying. A single $2 billion whale dump can trigger violent downdrafts, while MicroStrategy and ETFs' cumulative $83 billion purchases produce steadier appreciation. The difference lies in execution velocity.

"Price moves at the edges, not the averages," explains Plan C, creator of the Bitcoin Quantile Model. Algorithmic ETF purchases deliberately disperse orders to avoid market impact, building support floors gradually. Conversely, fat-finger sales exhaust liquidity pools instantly - like a piano dropped from ten stories.

This liquidity reality underscores Bitcoin's maturation. The same mechanisms that prevent parabolic spikes from institutional demand also provide stability against crashes. For traders, it's a reminder that in crypto markets, timeframes matter as much as dollar volumes.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical analysis and market developments, BTCC financial analyst William provides the following projections:

| Year | Price Target | Key Drivers |

|---|---|---|

| 2025 | $126,000 - $140,000 | ETF adoption, halving effects, institutional accumulation |

| 2030 | $250,000 - $350,000 | Global monetary debasement, network effects, scarcity premium |

| 2035 | $500,000 - $800,000 | Store of value narrative maturation, technological improvements |

| 2040 | $1,000,000+ | Full monetary premium, global reserve asset status |

These projections assume continued adoption and no catastrophic regulatory changes. Current support at $110,000 remains critical for maintaining bullish structure.